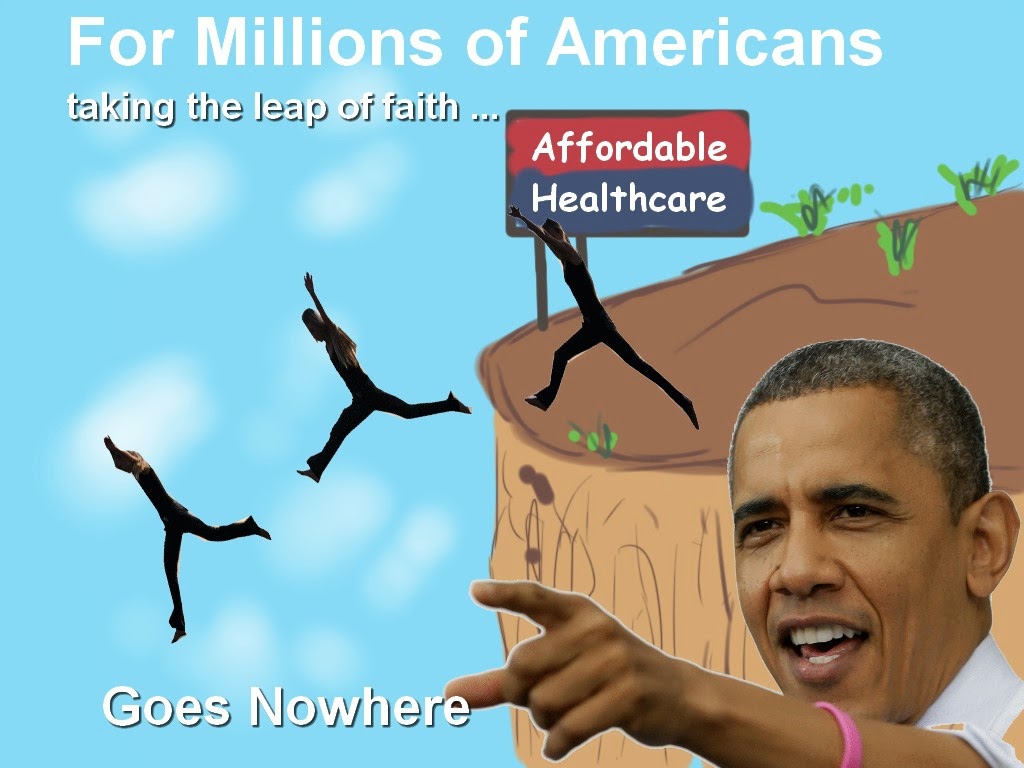

Now that enrollment has ended we can all sit back and enjoy

our affordable healthcare. Wrong. For millions upon millions of Americans, the

Affordable Healthcare Act is misleading and an impossible, unaffordable joke.

I am not one to disrespect a sitting president, nor will I

do that now. I fully believe that President Obama had all best intentions at

heart, and a nation’s health in mind, when creating the Affordable Healthcare

Act. In his enthusiasm to pass this bill, his passion and belief in it, he signed

Executive Order 13535. Because he couldn’t get the support. Basically, he took

it upon himself to make this law.

He made some pledges and promised, which again, I truly believe

he believed, that Americans could keep their coverage, would not lose it.

Yet, factcheck states 4.7 million Americans lost their current

insurance or would lose it in one year under the AHCA. Millions more will see

premiums rise.

That’s really not my issue of this blog though. I’m talking

about the millions of us, and I know I’m not the only one, who have fallen through

the cracks and guess what, according to the law, it’s fine that we run around

without insurance and Bonus … no fine.

I am self employed as a writer and far from rich. I have three

dependants on my taxes. Yet, believe it on or not, that doesn’t matter when

applying for AHC. Trust me, it doesn’t matter because I was only applying for

myself. Even though I listed them as dependants.

Basically my letter states.

Good news: You’re poor and qualify under federal guidelines

for FREE medical coverage.

Oh, my goodness, really, yeah!

Bad news: Your state didn’t expand their guidelines to meet

the federal limits so your state won’t cover you.

Huh, wait. So, I don’t get insurance now?

Good News: You can pick a plan from the market place.

Ok, but the lowest one is so high … wait, tax credit, I

heard about that, help to pay the premium …

Bad News: Because you qualify for free healthcare, you do

NOT qualify for a tax credit there for you don’t get a break or instant tax credits

to help pay premium prices.

Are you shitting me? What do I do now?

So you can pay the bargain monthly minimum Basic caveman premium

price of 346.00 a month with 6,900 out of pocket expenses or … don’t. Because

Bonus …you are exempt from paying a fine if you choose to go uninsured.

Ok, so back to square one. No health insurance. Ok, got it.

Where in the Government's mind is this right? Really? Think

about it. The federal government believes I deserve free healthcare, but won’t

give me a tax credit so I can pay for a premium since my state won’t cover me.

Like millions of Americans I am opting out. I just can’t

afford it, even basic, a 300.00 a month premium. I don’t know what my income is

from one month to the next. My taxes are high because I am self employed.

Somewhere, somehow, this could have all worked out, had it

been thought about a little better.

But what about those who don’t qualify for a tax credit, can’t

afford the premiums and aren’t exempt from the fine. Oh, yeah, there are people

too poor for the tax credit, and fall in the small margin that have to pay a

fine. What do they do?

I have good news. Don’t pay your gas bill, get a shut off

notice and file for a hardship exemption.

States right on the website …

If you have any of the

circumstances below that affect your ability to purchase health insurance

coverage, you may qualify for a “hardship” exemption:

1.

You were homeless.

2.

You were evicted in

the past 6 months or were facing eviction or foreclosure.

3.

You received a

shut-off notice from a utility company.

There’s an entire list, go check it out.

For now, I’m irritated that this thing has let me down and I have a headache. Good thing it’s nothing worse, because I don’t have healthcare to see a doctor. I’ll stick to our local ‘Doctor is In’ at 29.99 a pop located in the corner of our local grocery store pharmacy.

No comments:

Post a Comment